The Future of Financial Software

By: Alex Tong and the Information Venture Partners team

On the heels of our recently announced investment in Jirav, we wanted to highlight the opportunities we are witnessing today that impact the finance department of organizations worldwide. We have backed a number of next-gen technology companies modernizing the “office of the CFO”, including Adaptive Insights (financial planning for enterprises; exited to Workday), Q4 (investor relations management), Procurify (spend management) and now Jirav (cloud-based financial planning software for growing businesses).

The reality is today’s growing financial software landscape is no longer dominated by the original ERP vendors such as SAP and Oracle. While ERP pioneered financial software beginning in the mid-‘80s as an evolution to material resource planning systems (MRPs) of the ‘70s, the ERP of today has not kept up with the requirements of modern organizations. The original promise of the ERP was simple: a system of record for financial data across the organization in one unified “suite”. However, the benefit of a unified suite has waned over the years as (a) the demands for new products not yet met by ERPs rose in importance over time, e.g., “BI” tools, forecasting and planning (ERPs heritage is as a rear-view oriented system) and (b) ERP implementations became increasingly complex, over-budget and delayed as “native” functionality was haphazardly stitched together as a result of various M&A, one-off customizations and fragmented code on an antiquated tech stack.

Now more than ever, organizations need to be flexible and adopt modern solutions in order to survive, scale and/or thrive. With modern 21st century software development making integrations easier than ever, and the emergence of SaaS/cloud solutions accelerating the time-to-value and making a license more economical to many, the suites are increasingly ceding mind share and market share to best-of-breed financial software. Don’t believe me? Just look at Gartner’s recent Peer Insights “Voice of the Customer” rankings for financial software solutions such as “Cloud Financial Planning and Analysis”, “Cloud Financial Close Solutions” and “Procure-to-Pay Suites” – SAP or Oracle are nowhere to be found in the top right quadrant as “Customers’ Choice”[1].

We are now witnessing the beginnings of a profound shift in finance departments worldwide, and we remain bullish on financial software as it continues to remain a key focus area at our firm. When looking at the future, we believe in three core tenets that drive enterprise investment into modern financial software companies. That is:

(1) financial management is no longer just the CFOs job: there is an accelerated shift in management of financial ops from a centralized to a de-centralized approach – in other words, “finance” is every department’s responsibility. In that paradigm, we believe ease of use and collaboration-oriented solutions win;

(2) automation becomes the norm: there will be increased acceptance of modern technology to automate manual and legacy processes, and;

(3) finance truly becomes a strategic resource: finance evolves from a support function to a full-fledged strategic resource for the entire enterprise. Finance teams will increasingly redirect its intellectual resources to help deliver predictive and prescriptive guidance.

These core tenets underpin the investment rationale for our firm’s financial software practice.

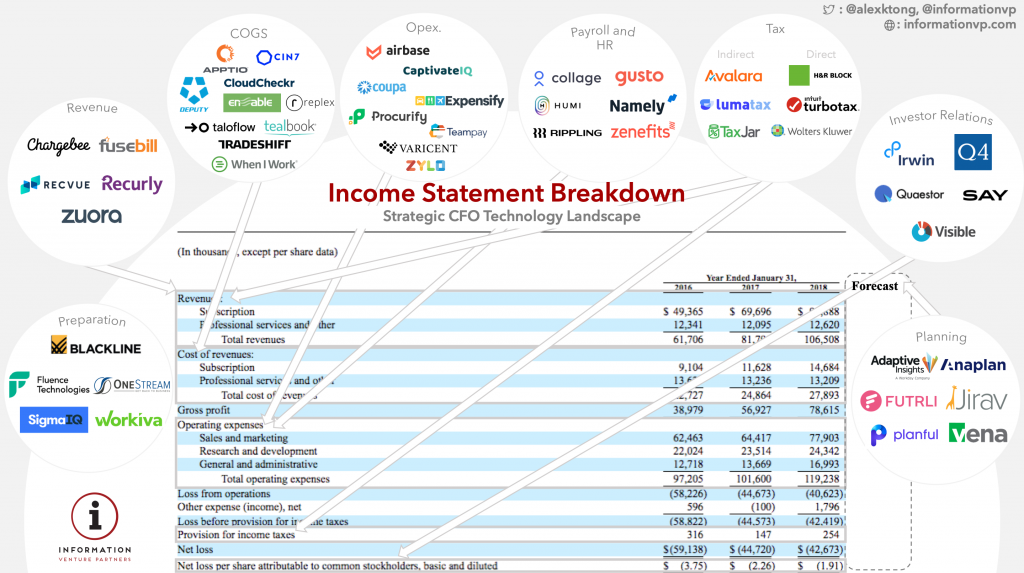

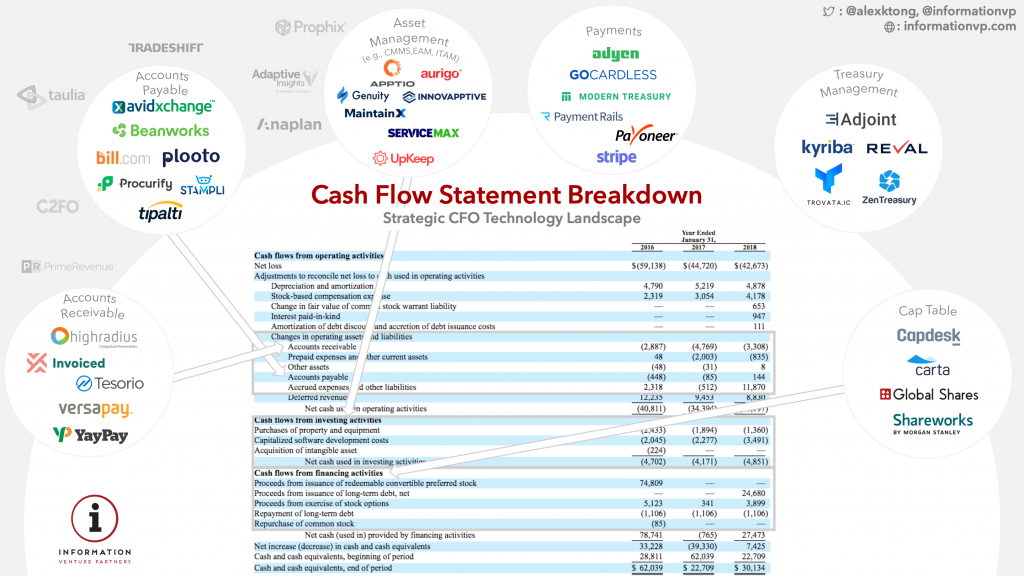

Below, we have prepared and illustrated a sample of modern technology companies (and select incumbents) delivering the next generation of solutions for the strategic CFO. These technology companies either directly impact the day-to-day of finance teams, or indirectly impact these teams given the nature of its offering. All of these companies are tackling and optimizing various areas of the P&L and cash flow of a business.

While the financial statements are a core output of the finance department (effectively an organization’s “report card”), the preparation, management and planning happens behind the scenes. These outputs are also continuously being monitored, measured, benchmarked and acted upon by suppliers, creditors, investors, employees, regulators and others. When you examine these breakdowns, you can see the profound impact best-of-breed solutions could have on the financial health of a company. On the income statement, organizations could be using technology to manage revenues (e.g., Chargebee, Zuora), COGS/direct expenses (e.g., Deputy, Taloflow, Tealbook) and operating/indirect expenses (e.g., Captivate IQ, Expensify, Procurify, Varicent). On the cash flow statement, “cash is king” and organizations could employ technology to manage working capital (e.g., Avidxchange, Tesorio), supply chain finance (e.g., PrimeRevenue, C2Fo, Tradeshift), capital intensive IT and non-IT assets (e.g., Apptio, ServiceMax) and capitalization (e.g., Capdesk, Carta, Shareworks).

We believe that there are many opportunities for technology companies to unpack and attack each element of the financial statement above, and embody what we believe are the three core tenets underpinning modern financial software.If you are building a modern financial software business, we’d love to learn more. Please feel free to email and get in touch with us.

—

[1] Based on reviews by customers of each vendor, as opposed to Gartner itself. Customers’ Choice vendors generated “High” review coverage and a “High” overall rating. Sources: Gartner Peer Insights Customers’ Choice – Procure-to-Pay Suites (September 30, 2019), Cloud Financial Close Solutions (January 31, 2020) and Cloud Financial Planning & Analysis Solutions (October 31, 2019).